Saudi Mega Projects & Construction: SAR1.3 Trillion Budget Fuels 2025 Growth

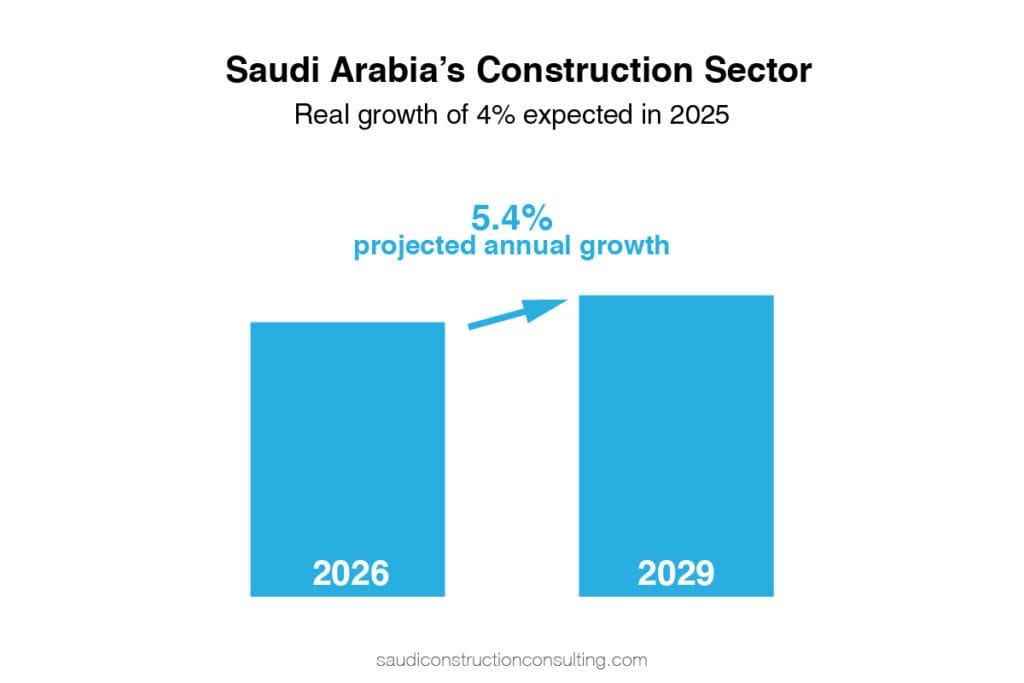

Saudi Arabia’s construction sector is entering a dynamic phase, with real-term growth projected at 4% in 2025 and an annual average of 5.4% from 2026 to 2029. This momentum is powered by the Kingdom’s ambitious fiscal planning and strategic infrastructure investments under the banner of Saudi Mega Projects & Construction.

SAR1.3 Trillion Budget Sets the Stage for 2025 Expansion

The Kingdom’s 2025 Budget allocates SAR1.3 trillion ($342.7 billion) in total expenditure, marking a notable increase from SAR1.251 trillion ($333.6 billion) in 2024. This fiscal boost is expected to directly support construction output in 2025, enabling the launch and acceleration of key infrastructure projects across sectors.

Saudi Mega Projects & Construction initiatives are central to this budgetary strategy, channeling funds into transport, electricity, housing, and water infrastructure—pillars of national development and urban transformation.

SAR2.3 Billion Sewage Projects Signal Environmental Commitment

In May 2025, Saudi Arabia’s National Water Company (NWC) unveiled plans to award 15 sewage infrastructure projects valued at over SAR2.3 billion ($613.3 million). These projects aim to enhance wastewater services and operational efficiency, reinforcing the Kingdom’s commitment to environmental sustainability.

Among the standout initiatives is the Eastern Tunnel Project in Jeddah, a SAR774 million ($206.4 million) undertaking that involves constructing a 14km sewage pipeline. Designed to improve environmental conditions across ten major districts, this project exemplifies the scale and impact of Saudi Mega Projects & Construction.

Another major investment is the SAR915 million ($244 million) airport sewage lifting project, engineered to handle a capacity of 611,000m³/day. This initiative is expected to reduce pollution and expand service coverage in critical urban zones, aligning with broader goals of infrastructure modernization.

Data Centers & AI Investments Reshape the Construction Landscape

Beyond traditional infrastructure, Saudi Mega Projects & Construction are increasingly intertwined with digital transformation. In May 2025, the Gulf Cooperation Council (GCC) witnessed a surge in data center and AI-related investments, driven by geopolitical shifts and the global race for technological leadership.

Leading firms such as KKR and ADQ are spearheading multi-billion-dollar ventures. KKR’s SAR18.8 billion ($5 billion) expansion of Gulf Data Hub and ADQ’s SAR93.8 billion ($25 billion) power infrastructure plan are designed to support the region’s growing data center ecosystem. These projects not only diversify the construction portfolio but also position Saudi Arabia as a hub for digital infrastructure in the Middle East.

2026–2029: Sustained Growth at 5.4% Annually

Looking ahead, the construction sector is poised to maintain robust growth, averaging 5.4% annually from 2026 to 2029. This trajectory is underpinned by continued investments in Saudi Mega Projects & Construction, spanning water, energy, housing, and digital infrastructure.

Also Read: The Saudi Arabia’s Mega Construction Projects Shaping the Future