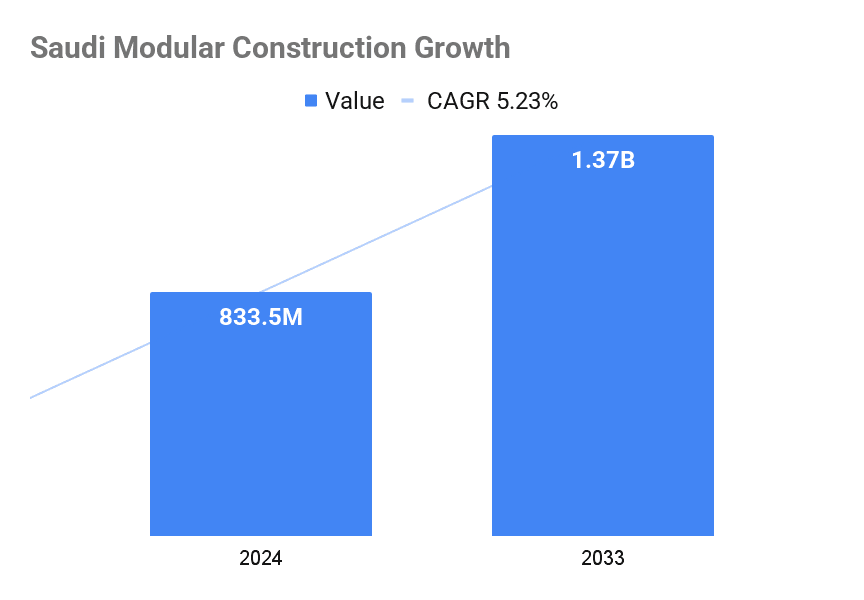

Market Overview: Saudi Modular Construction Market to Hit $1.37B by 2033

The modular method is emerging as a cornerstone of Saudi Arabia’s modernization strategy. The Saudi Modular Construction Market is projected to grow from USD 833.5 million in 2024 to USD 1.37 billion by 2033, reflecting a CAGR of 5.23%. This growth is fueled by giga-projects like NEOM, Qiddiya, and The Line, which demand scalable, fast, and sustainable building solutions.

In The Line, modular construction is set to deliver over one-third of the built environment, laying the foundation for Saudi Arabia’s move toward scalable, off-site building solutions.

Advantages of Modular Methods: 50% Faster, 45% Greener

Modular construction offers compelling advantages over traditional methods, particularly in the Saudi context:

- Speed: Projects using modular techniques can be completed up to 50% faster, thanks to parallel off-site fabrication and on-site assembly.

- Cost Efficiency: Controlled factory environments reduce labor costs and material waste, improving budget predictability.

- Sustainability: Digital tools like BIM and 3D printing help reduce carbon emissions by up to 45%, aligning with Vision 2030’s environmental goals.

- Quality Control: Standardized production ensures consistent quality, minimizing defects and rework.

- Flexibility: Modular designs are highly customizable, supporting diverse applications from housing to healthcare.

These benefits are especially critical in remote regions like NEOM, where logistics and climate challenges make traditional construction impractical.

Key Projects and Investors: Giga-Projects Drive Ecosystem Expansion

Saudi Arabia’s modular construction momentum is anchored in large-scale developments and a growing network of solution providers:

- NEOM and The Line: These flagship projects are deploying modular villages, infrastructure pods, and service facilities to accelerate timelines and reduce logistical complexity. Modular methods now account for a significant share of NEOM’s built environment, especially in remote zones.

- Qiddiya and Amaala: Entertainment and tourism hubs are adopting modular hotels, clinics, and transport nodes to meet aggressive delivery schedules.

- Cross-Border Partnerships: International engineering and prefab firms are collaborating with Saudi manufacturers to localize production and meet IKTVA targets. This includes turnkey solutions for housing, healthcare, and logistics infrastructure.

- Domestic Expansion: Saudi-based steel and prefab companies are scaling up modular manufacturing capacity, investing in automation and digital integration to meet rising demand.

Rather than relying on a single player, the Saudi Modular Construction Market is evolving into a multi-actor ecosystem—where global expertise meets local execution, and modular workflows are tailored to sectoral needs.

Policy Support: Vision 2030 and Housing Incentives Accelerate Adoption

Government backing is a key driver of modular adoption:

- Vision 2030 Alignment: Modular construction supports goals around economic diversification, sustainability, and rapid urbanization.

- IKTVA Program: Incentivizes local content development, encouraging domestic modular manufacturing.

- Housing Sector Push: The Ministry of Municipal and Rural Affairs and Housing actively promotes modular methods to meet rising demand for affordable homes.

- Regulatory Compliance: Modular projects are now integrated with Saudi Building Code (SBC), ensuring safety and durability standards are met.

Modular isn’t just gaining ground. It’s being codified, scaffolded, and scaled through Saudi Arabia’s evolving policy architecture.

Future Growth Potential: Urbanization and Tech to Drive $1.37B Market

Looking ahead, the Saudi Modular Construction Market is poised for sustained expansion:

- Urbanization Surge: By 2050, 90% of GCC residents will live in urban centers, intensifying demand for rapid infrastructure deployment.

- Digital Integration: Technologies like digital twinning, machine learning, and AR are optimizing modular workflows and reducing waste.

- Sectoral Diversification: Beyond housing, modular methods are expanding into education, retail, hospitality, and healthcare.

- Local Manufacturing: To counter transport and material volatility, Saudi firms are investing in domestic prefab factories.

Projected to hit USD 1.37 billion by 2033, modular construction is engineering a new era of precision, scalability, and infrastructure intelligence in Saudi Arabia.

Read: European Modular Innovation Finds Scale in $1.3T Saudi Push