Saudi Arabia’s Construction Sector Consolidates Amid Development Boom

Saudi Arabia is experiencing a transformative era within its construction sector, highlighted by unprecedented growth and consolidation. As the Kingdom surges ahead with ambitious mega and giga projects like Qiddiya, Red Sea, and Amaala, the Saudi Construction Boom continues to reshape both the local landscape and the industry itself. The sector’s pipeline of projects, valued at an impressive $1.5 trillion, positions it as a global contender for dominance by 2028.

Evolving Market Dynamics

With the sector projected to reach $181.5 billion by 2028, Saudi Arabia is not only setting records but also fostering a competitive and consolidated market. The rapid awarding of $569 billion in contracts between 2021 and 2025 demonstrates the urgency to address demand fueled by urbanization, population growth, and the preparation for global events like Riyadh Expo 2030 and FIFA World Cup 2034.

This consolidation trend is driven by leading domestic and international players such as Grankraft, Waagner Brio Steel and Glass, and WBG. These entities are deploying specialized expertise, making them instrumental in managing over 40% of the $1.1 trillion unawarded project value. By streamlining efforts and fostering partnerships, these firms reduce redundancy, optimize resources, and enhance project outcomes, solidifying Saudi Arabia’s reputation as a robust construction hub.

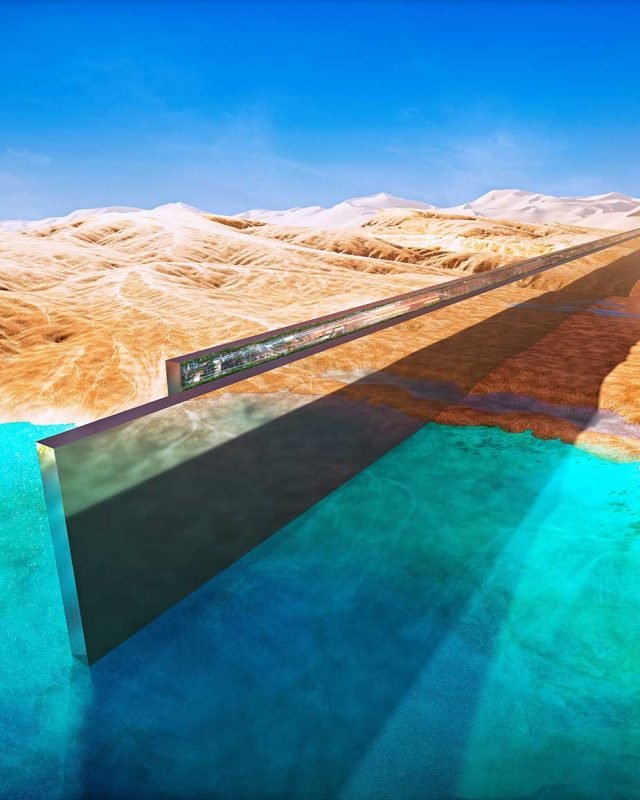

Also Read: Mega Projects Underway: The Future of Urban Living in NEOM

Riyadh: A Catalyst for Growth

At the epicenter of the Saudi Construction Boom is Riyadh, securing over $140 billion in contracts in 2023 alone. The government’s initiatives to grow the city’s population to 10 million by 2030 have made Riyadh a hotspot for international businesses. Incentives under the “Regional Headquarters” program, such as tax exemptions and reduced Saudization requirements, attract foreign firms eager to establish operations in this dynamic market.

Driving Economic Diversification

Tourism is both a catalyst and a beneficiary of this construction surge. Saudi Arabia aims to host 150 million visitors by 2030, necessitating the addition of 320,000 new hotel rooms. By intertwining hospitality growth with construction efforts, the sector accelerates the Kingdom’s Vision 2030 goals of economic diversification and a 10% GDP contribution from tourism.

This focus on hospitality dovetails with Saudi Arabia’s pursuit of housing solutions. Aiming to raise the real estate sector’s GDP contribution from 6% to 10% by 2030, the government is addressing heightened demand for residential and commercial properties. Rapid urbanization and strategic investments reinforce the construction sector’s trajectory, facilitating sustainable economic growth.

Challenges and Opportunities

Despite these advancements, challenges such as supply chain disruptions and fluctuating material costs demand meticulous risk management. Tender price inflation reached an average annual rise of 5% in 2022 and is anticipated to climb 6% in 2023. Contractors and developers must adopt cost-management techniques and digitized solutions to mitigate risks, ensuring timely project delivery.

A Look Ahead

The consolidation of Saudi Arabia’s construction sector reflects a dynamic evolution driven by strategic investments and global collaboration. As the Saudi Construction Boom propels the Kingdom toward becoming the world’s largest construction market by 2028, the emphasis on streamlined operations, skilled talent, and innovative practices will play a pivotal role in achieving Vision 2030’s ambitions. For industry players, this is not just a boom—it is an era of opportunity.