Saudi Construction Output Forecast to Reach $191 Billion by 2029

According to recent forecasts, Saudi construction output is expected to reach $191 billion by 2029, marking a 29.05% increase from $148 billion in 2024. This growth is driven by large-scale infrastructure investments, residential expansion, and commercial development under the country’s Vision 2030 strategy.

$215.4 Billion in Contracts Awarded Since 2020

Between 2020 and 2025, Saudi Arabia awarded over $215.4 billion in construction contracts, spanning sectors such as transport, energy, water, and urban development. These figures highlight the government’s commitment to positioning the Kingdom as a global center for trade, tourism, and innovation.

Riyadh Leads with $135.2 Billion in Construction Activity

Riyadh has emerged as the focal point of Saudi construction output, with $135.2 billion in contracts awarded since 2020 — accounting for 63% of the national total. The capital’s $195 billion development plan includes:

- 4.6 million sq. meters of office space

- 2.6 million sq. meters of retail space

- Over 340,000 residential units

- More than 28,800 hotel rooms

These projects are designed to accommodate the city’s projected population growth to 10 million by 2030, while attracting global businesses through incentives like tax exemptions and operational support.

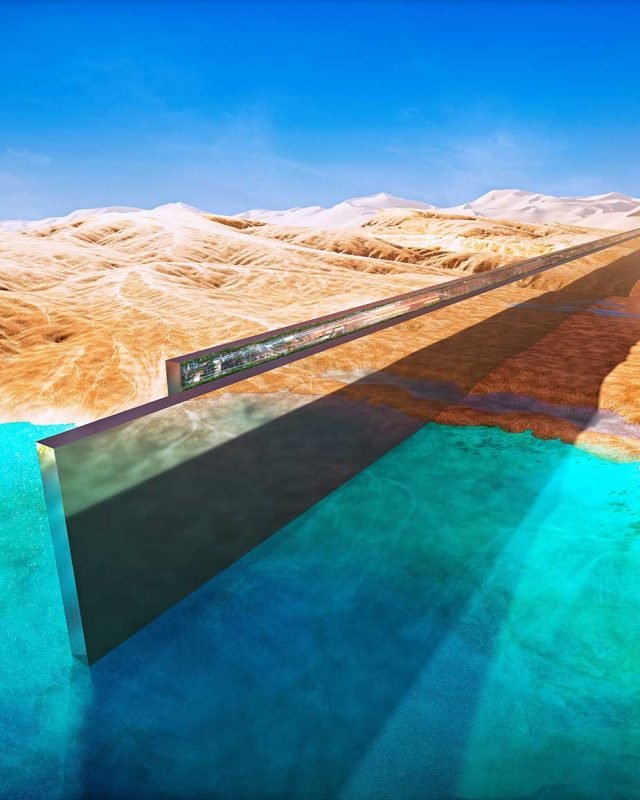

$1.3 Trillion Investment Pipeline Under Vision 2030

Saudi Arabia’s Vision 2030 outlines a $1.3 trillion investment pipeline in real estate and infrastructure. The Western Region alone accounts for 53% of this total, driven by giga-projects such as:

- New Murabba in Riyadh: $50 billion to develop 18 neighborhoods across 19 sq. km

- Western Region Giga Projects: $685.5 billion for 382,000 homes, 330,000 hotel rooms, and 7.3 million sq. meters of commercial space

These developments are among the largest in the EMEA region and are designed to create futuristic urban ecosystems that blend sustainability, technology, and livability.

Transport Infrastructure Expands with $22.5 Billion Metro Project

To support rapid urbanization, Riyadh is investing heavily in transport infrastructure. The Riyadh Metro, a $22.5 billion project, features:

- Six lines spanning 176 km

- 85 stations

- Fully automated, driverless trains

Complementing this is the King Abdulaziz Public Transport Project, which will establish a comprehensive bus rapid transit system. An additional $5 billion is being allocated to major road projects, reinforcing the city’s connectivity and supporting its expansion.

Office Space Demand Surges Amid Corporate Incentives

Grade A office rents in Riyadh rose 23% year-on-year, reaching SR2,700 ($719.95) per sq. meter. This spike is driven by initiatives like the regional headquarters program, which offers:

- 30-year exemption from corporate income and withholding tax

- Discounts and support services for international firms

These incentives are attracting global companies and reinforcing Riyadh’s position as a commercial hub.

Construction Licenses and Sector Growth Indicators

In 2024 alone, 3,800 new construction licenses were issued, bringing the total to 8,900. This reflects strong investor confidence and a robust pipeline of upcoming projects. The sector’s compound annual growth rate is projected at 8% through 2029, with the real estate market expected to reach $101.62 billion by the end of the decade.

Also Read: Saudi Construction Industry Transformation: What’s Ahead?